SMS Marketing Statistics in 2026: Benchmarks, Revenue, and ROI Data for Ecommerce

Updated SMS marketing statistics for 2026 — revenue per message, conversion rates, and ROI benchmarks — plus text-to-buy performance data that challenges what most brands assume about the channel.

SMS marketing is booming. Message volume grew 40% year over year in 2025, outpacing every other marketing channel. But here's what the raw growth numbers don't tell you: most brands are still using SMS the same way they used it five years ago — blasting links and hoping for clicks.

The data tells a clearer story about what actually works. Below, we break down the latest SMS marketing statistics, compare them against email benchmarks, and show what happens when you stop treating SMS as a traffic channel and start treating it as a sales channel.

All industry-wide statistics referenced below come from a 2026 ecommerce marketing report¹ analyzing data from 150,000 brands and 321 million SMS messages sent in 2025. Text-to-buy statistics come from AudienceTap's internal platform data.

SMS Is the Fastest-Growing Marketing Channel

- 321 million SMS messages were sent by ecommerce brands in 2025

- SMS volume grew 40% year over year — up from 31% growth the year prior

- Ecommerce order volume itself grew 98% YoY, and SMS growth is keeping pace with that expansion

The channel is still small compared to email (27 billion emails sent in the same period), but it's growing faster and has structural engagement advantages that email can't match.

SMS Engagement Statistics

SMS consistently outperforms every other channel on raw engagement:

- 98% open rate for SMS messages (compared to 30.7% for email)

- 95% of texts are read within 3 minutes of delivery

- SMS click rates more than doubled year over year in 2025

- Average email read time is measured in hours; SMS is measured in minutes

These numbers explain why brands keep investing in the channel. The attention is there. The question is what you do with it.

SMS Revenue Per Message: The Benchmark That Matters Most

This is where most SMS marketing reports stop — and where the real story starts.

According to 2025 data across 150,000 brands¹:

| SMS Type | Revenue Per Send |

|---|---|

| SMS campaigns (broadcasts) | $0.15 |

| SMS automations (triggered messages) | $0.74 |

Automated SMS messages generate 5x more revenue per send than broadcast campaigns. This mirrors a pattern across every channel — behavior-triggered messages dramatically outperform batch-and-blast.

But both of these numbers assume the customer has to leave the text thread, click a link, load a page, and complete a checkout. What happens when you remove that friction entirely?

| SMS Type | Revenue Per Send | Relative Performance |

|---|---|---|

| SMS campaigns (broadcasts) | $0.15 | Baseline |

| SMS automations (triggered) | $0.74 | 5x campaigns |

| Text-to-buy drops | $2.01 | 13x campaigns |

Text-to-buy — where customers purchase by replying to a text with no link, no cart, and no checkout page — generates $2.01 per message sent. That's 13x more than a standard SMS campaign and nearly 3x more than the best automated SMS.

The difference isn't better copy or better timing. It's removing the link entirely.

SMS Conversion Rate Statistics

Conversion rates tell a similar story:

- 0.97% — SMS click-to-conversion rate globally¹

- 5.5% — Average text-to-buy drop conversion rate (AudienceTap platform data)

A few notes on what these numbers mean:

The industry figure (0.97%) measures click-to-conversion — of people who click the link in an SMS, fewer than 1 in 100 complete a purchase. The total conversion rate (orders divided by messages sent) is even lower, since most recipients never click at all.

The text-to-buy figure (5.5%) measures total conversion — orders divided by messages sent. There's no click step. The customer replies to buy, and the order is placed inside the conversation.

Individual text-to-buy programs regularly exceed those averages:

| Brand | Conversion Rate | Revenue/Message | ROI |

|---|---|---|---|

| Tinker Coffee Co. | 8.6% | $1.93 | 13.9x |

| Fellow Drops | 6.2% | $1.94 | 32x |

| Pull & Pour Coffee Club | 5.2% | $1.88 | 35.3x |

SMS vs Email: Side-by-Side Comparison

Using 2025 industry data¹, here's how the two channels stack up:

| Metric | SMS | |

|---|---|---|

| Messages sent (2025) | 27 billion | 321 million |

| Open rate | 30.7% | 98% |

| Click-to-conversion rate | 9.0% | 0.97% |

| Campaign revenue/send | $0.18 | $0.15 |

| Automated revenue/send | $2.87 | $0.74 |

| Read time | Hours | Minutes |

Email has higher click-to-conversion rates because the people who open and click an email are already highly engaged. SMS has dramatically higher reach and immediacy — 98% of messages are seen, and most are read within minutes.

The takeaway isn't that one channel is "better" than the other. It's that they serve different roles. Email excels at nurturing and complex messaging. SMS excels at urgency, immediacy, and action.

Where SMS falls short is the handoff. A text gets read, the customer is engaged, and then... they're sent to a link. They leave the conversation. They wait for a page to load. They navigate a checkout. That's where most of the 99% drop-off happens.

The Automation Gap: Why Triggered Messages Win

One of the clearest patterns in the industry data is the gap between campaigns and automations — and it holds across every channel:

| Channel | Campaign Revenue/Send | Automated Revenue/Send | Automation Advantage |

|---|---|---|---|

| $0.18 | $2.87 | 16x | |

| SMS | $0.15 | $0.74 | 5x |

For email, automations represent just 2% of total sends but generate 30% of total revenue. The top automation types — abandoned cart and welcome messages — account for 76% of all automation-generated orders.

This makes intuitive sense. A behavior-triggered message arrives when the customer is already thinking about you. A broadcast arrives when you decide to send it.

SMS automation follows the same pattern, just with a smaller multiplier (5x vs 16x for email). The gap is smaller because even automated SMS still relies on links to checkout pages — the urgency advantage of SMS narrows once the customer lands on the same checkout flow they'd reach from an email.

The Growth Is Concentrated

One more data point worth noting: Industry research found that the top 5% of brands drove 57% of total ecommerce order growth in 2025. The top 20% drove 81%.

Growth isn't distributed evenly. A small number of brands are pulling dramatically ahead, and the gap is widening. The common thread among the outliers isn't that they're sending more messages — it's that they're using their channels differently.

What Happens When You Remove the Link Entirely

The logical next step beyond automation is removing the friction point altogether. That's what text-to-buy does — the entire purchase happens inside the text conversation.

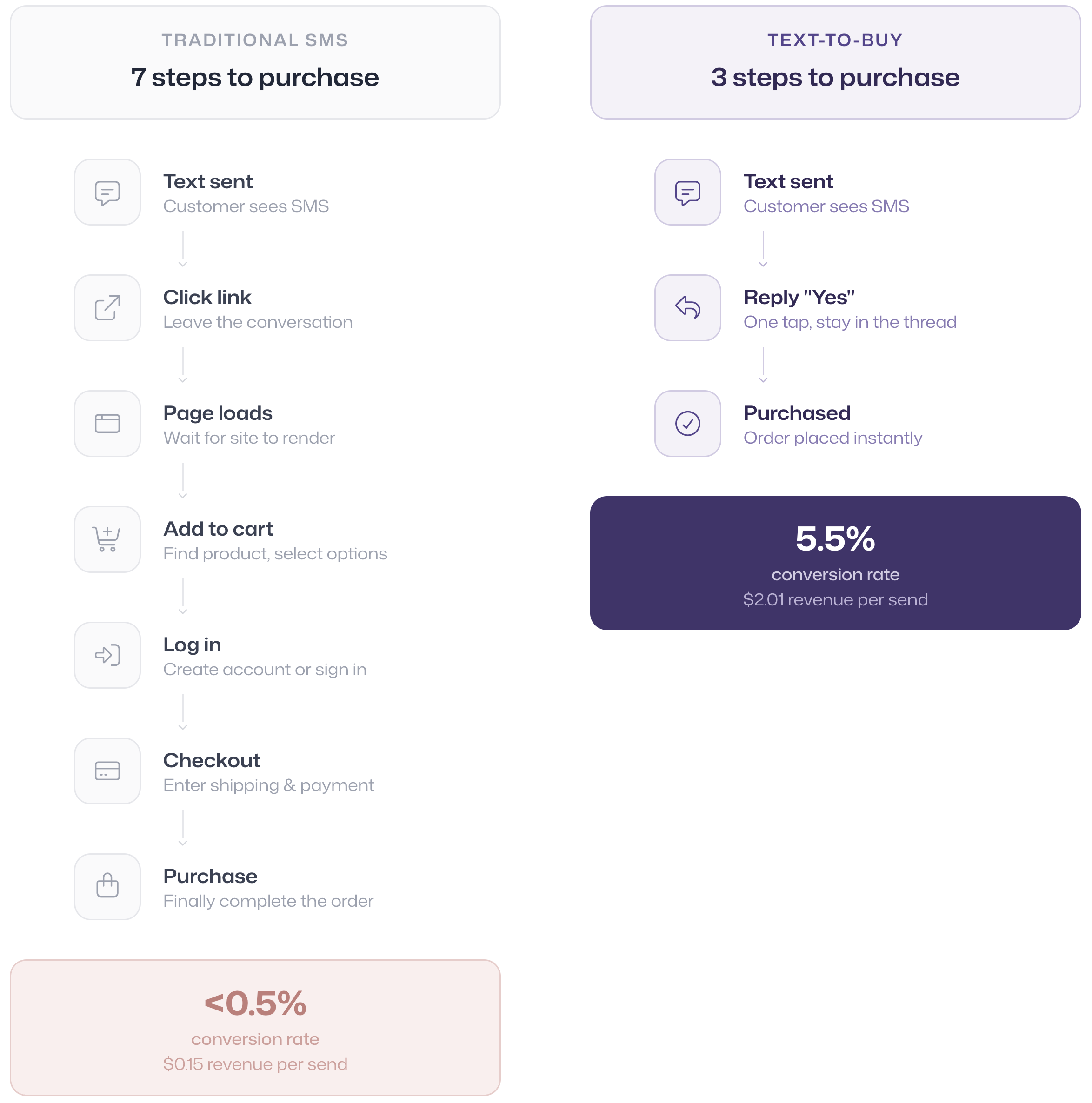

Instead of 7 steps to complete a purchase, it becomes 3 — and the customer never leaves the text thread.

Brands running text-to-buy programs see:

- $2.01 revenue per message vs $0.15 for SMS campaigns (13x)

- 5.5% conversion rate vs sub-1% for link-based SMS

- 3x higher overall spend from customers who buy via text

- ROI of 13x to 35x across published case studies

This isn't a marginal improvement to SMS marketing. It's a fundamentally different use of the channel — one where SMS isn't driving traffic somewhere else, but closing the sale itself.

What These Statistics Mean for Your SMS Strategy

The data points to a clear hierarchy of SMS performance:

- SMS campaigns (batch-and-blast) are the baseline — $0.15/send, sub-1% conversion

- SMS automations (behavior-triggered) are 5x better — $0.74/send

- Text-to-buy (no link, no cart) is 13x better than campaigns — $2.01/send, 5.5% conversion

If you're running SMS campaigns today, the first move is automating your highest-value flows: welcome messages, reorder prompts, and abandoned cart recovery. That's where the industry data shows the biggest lift for traditional SMS.

The second move is asking whether your customers even need to leave the text thread at all. For product drops, reorders, and anything where the customer already knows what they want, removing the checkout entirely closes the gap between SMS attention (98% open rate) and SMS revenue (currently $0.15/send for most brands).

The brands in that top 5% aren't sending more texts. They're making each text do more.

¹ Source: Omnisend 2026 Ecommerce Marketing Report — analysis of 150,000 brands, 27 billion emails, and 321 million SMS messages sent in 2025.

AudienceTap is a text-to-buy platform that lets customers purchase products by replying to a text message — no links, no carts, no checkout pages.

With reply-to-buy purchasing, AI-timed replenishment drops, abandoned cart recovery, and list growth tools, AudienceTap turns SMS from a traffic channel into a sales channel. Brands on the platform average $2.01 in revenue per message and 5.5% conversion rates on drops.

Talk to a text-to-buy expert to see how it can transform your SMS marketing program.