Text-to-Buy Meets Dropshipping: How Curator Brands Use Shopify Collective to Run Seamless SMS Drops

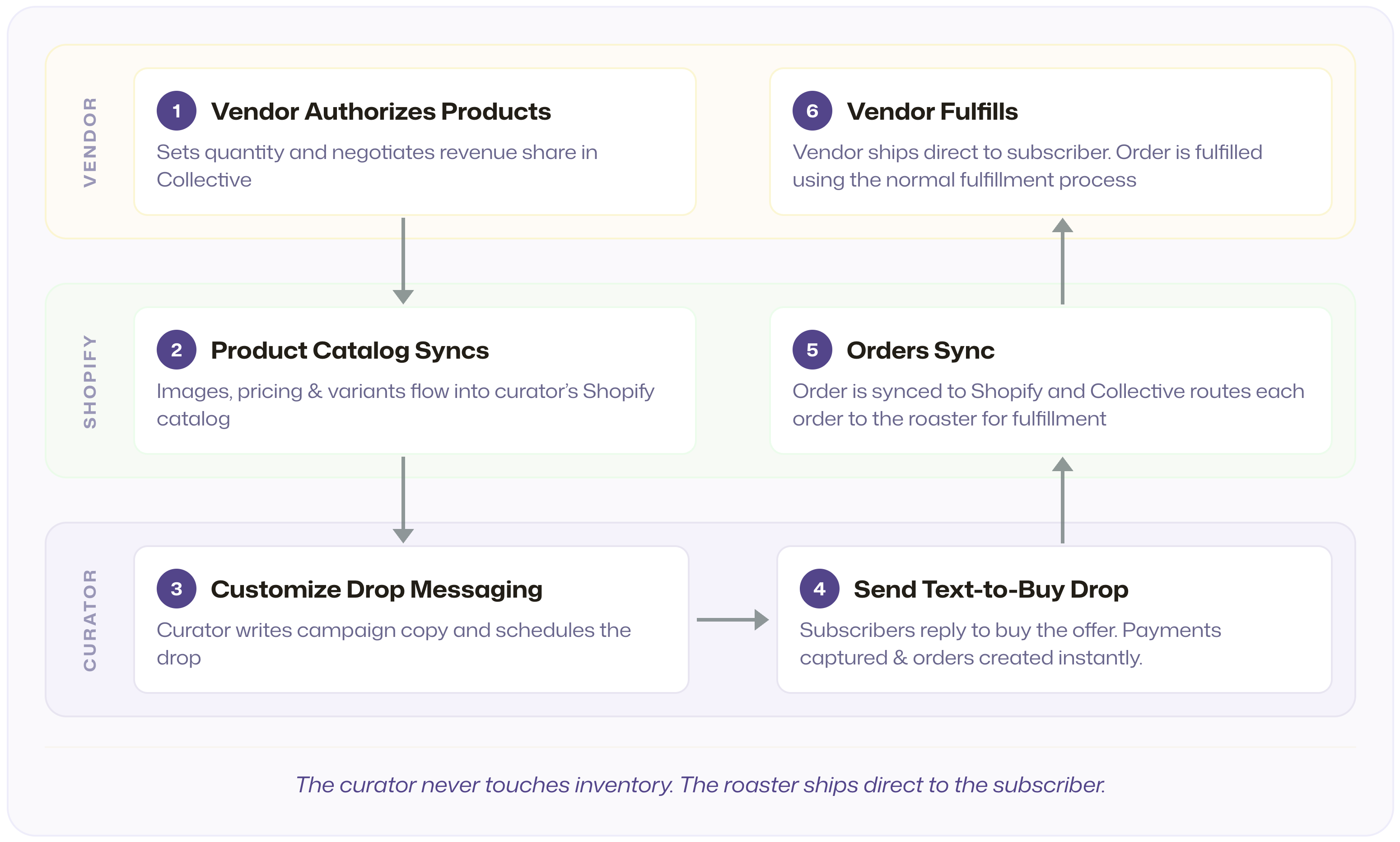

Curator brands that partner with rotating vendors can combine Shopify Collective's seamless dropshipping with text-to-buy to run high-converting product drops — no inventory, no checkout friction, no operational scaling pain.

Some of the most compelling ecommerce brands don't make anything.

They curate. They build audiences around a product category — specialty coffee, natural wine, craft spirits, small-batch hot sauce — and partner with rotating producers to bring their subscribers access to products they wouldn't find on their own.

It's the gallery model applied to ecommerce. The curator provides the audience and the brand. The product vendor provides the product. When those two things connect through the right infrastructure, the result is a business that scales without scaling inventory, warehousing, or fulfillment.

That infrastructure exists today — and it's simpler than most operators think. The combination of Shopify Collective for product sourcing and dropshipping, plus text-to-buy for instant checkout, creates a flywheel that gets more efficient with every product vendor you add.

Here's how it works.

The Curator Brand Model

Curator brands operate differently from traditional DTC. They don't manufacture products, hold inventory, or manage fulfillment. Instead, they do three things exceptionally well:

- Build an audience around a product category

- Source products from a rotating roster of vendors

- Create urgency through limited-edition drops and exclusive access

The curator's value isn't in the product itself — it's in the curation, the trust, and the direct relationship with an audience that wants to discover what's next.

This model works particularly well for product categories where variety is part of the appeal. Coffee drinkers want to try new roasters. Wine enthusiasts want to explore new regions. Cigar aficionados want access to limited releases. The curator brand gives them a single trusted channel for all of it.

The challenge has always been operational. Every new product vendor means a new relationship to manage, new products to list, new fulfillment workflows to coordinate. Historically, this complexity scaled linearly with partnerships — adding ten product vendors meant ten times the operational work.

That's no longer the case.

How Shopify Collective Changes the Game

Shopify Collective is Shopify's native feature that lets brands sell products from other Shopify stores without purchasing inventory upfront. For curator brands, it's the infrastructure layer that makes the entire model work.

Here's the mechanics:

Vendor authorization. A product vendor — say, a specialty coffee roaster — authorizes specific products for sale through the curator's store. They set the maximum available quantity for each product, negotiate revenue share, and control which items are available.

Automatic product sync. Once authorized, those products flow directly into the curator's Shopify catalog. Product images, descriptions, pricing, and variants are all pulled from the vendor's data. The curator doesn't have to build product pages from scratch.

Real-time order routing. When an order is placed in the curator's Shopify store, Collective automatically routes it to the vendor's Shopify account. The vendor sees the order in their existing dashboard, in real time, and fulfills it directly.

The curator never touches the product. The vendor ships directly to the end customer.

This is dropshipping in the truest sense — but unlike third-party dropshipping platforms, everything lives inside Shopify's ecosystem. Both sides manage their business through tools they already know.

Layering Text-to-Buy on Top

Shopify Collective solves the sourcing and fulfillment side. But how do you actually sell these products to your audience in a way that matches the urgency and exclusivity of a drop?

This is where text-to-buy completes the picture.

The curator selects a Collective-sourced product from their Shopify catalog and configures a drop — setting the quantity, the messaging, and the timing. When the drop goes live, an SMS campaign goes out to subscribers. The text describes the product, shows the price, and invites them to reply to purchase.

A subscriber replies. The order is created in the curator's Shopify store. Shopify Collective routes the order to the vendor. The vendor begins fulfillment immediately — often while the drop is still live.

The entire transaction happens inside a text conversation. No links. No checkout pages. No cart abandonment. The subscriber goes from discovering the product to owning it in a single reply.

For curator brands running weekly or bi-weekly drops, this creates a rhythm that subscribers look forward to. Each drop is a moment — a limited window to grab something exclusive. And the combination of text-to-buy and Collective means the curator can run these drops at high frequency without drowning in operational work.

Why Drops Work Where Marketplaces Struggle

Shopify Collective is a powerful tool. But if you read the forums and review threads, you'll find a long list of operators frustrated with the experience — shipping complexity, brand confusion, thin margins, partner quality issues.

Here's the thing: almost all of those problems come from running Collective like an always-on marketplace. A curator brand running drops operates differently, and the drop model sidesteps the pain points that trip up marketplace operators.

Shipping complexity disappears. The biggest complaint about Collective marketplaces is split shipments. A customer orders from three vendors and gets three packages with three shipping charges. With drops, you're selling one product from one vendor at a time. One shipment, one tracking number, one fulfillment workflow.

Brand confusion is a non-issue. Marketplace operators struggle because vendor packing slips and return labels carry the vendor's branding — not the retailer's. Customers get confused about who they bought from. In a drop model, the subscriber already knows the product is sourced from a specific vendor. That's part of the story. The curator introduces the roaster, the winemaker, the producer by name. Transparency isn't a bug — it's the pitch.

Product data only needs to sync once. Marketplace operators deal with ongoing maintenance as vendors update descriptions, images, and pricing. With a drop, you pull the product data once, review it, configure the drop, and run it. There's no long-term catalog to maintain.

Partner quality is built in. Marketplace operators get flooded with connection requests from low-quality "everything stores" and dropshipping aggregators looking to bulk-import catalogs. Curator brands running drops don't have this problem — every vendor relationship is intentional, every product is hand-picked, and every drop is a deliberate editorial choice.

The difference is structural. A marketplace is an always-on storefront with dozens of vendors, thousands of SKUs, and endless operational surface area. A drop is a focused, one-vendor, one-product moment. Collective's infrastructure handles both — but the drop model plays to its strengths.

What Vendors Get Out of It

The vendor side of this equation is just as compelling.

When a vendor partners with a curator brand using Shopify Collective and text-to-buy, they get:

Access to a built audience. The curator has already invested in growing and nurturing a subscriber list of engaged buyers. The vendor gets exposure to that audience without spending a dollar on customer acquisition.

Zero new software to learn. Orders show up in the vendor's existing Shopify dashboard. They fulfill them the same way they fulfill every other order. There's no new platform to onboard, no new workflows to build, no technical integration to manage.

Real-time order flow. Orders appear the moment they're placed. The vendor can begin processing and shipping immediately — there's no batch export, no delay, no reconciliation step.

Controlled exposure. The vendor decides which products are available, how many units to offer, and what the revenue share looks like. They maintain full control over their brand and inventory.

No channel cannibalization. This is a big one. One of the most common reasons vendors pull out of Collective marketplace arrangements is that retailers start running Google Shopping ads and Facebook carousel ads with the vendor's products — competing directly with the vendor's own campaigns in search results. Text-to-buy drops don't create public product listings. There's no product feed for a retailer to advertise against. The entire transaction happens inside a private SMS channel to an owned audience. The vendor gets exposure to new customers without creating a new competitor in the SERPs.

Low-risk partnership testing. A single drop is a low-commitment way for a vendor to test a curator relationship. Ship 100–200 units, see how fulfillment goes, evaluate the customer experience, and decide whether to come back for another round. Compare that to a wholesale commitment or an ongoing marketplace listing — a one-time drop lets both sides test the waters before going deeper.

Exclusive offers that protect brand equity. Drops give vendors room to create channel-specific exclusives — a unique product, a special bundle, or pricing that only exists for this audience. That exclusivity reduces the saturation fatigue that plagues marketplace distribution and gives the curator something distinct to promote. Some of the strongest vendor relationships start with a single exclusive drop and grow from there.

For many vendors, this is the simplest distribution channel they've ever used. They authorize a product, wait for orders, and ship. And some of those text subscribers become long-term direct customers — a nice bonus on top of the immediate revenue.

A Drop in Action: Start to Finish

Here's what a typical drop looks like using this model.

Monday: A single-origin coffee roaster reaches out to the curator brand about a new limited-release Ethiopian natural process. They agree on terms — 200 bags available and a negotiated revenue share. The roaster authorizes the product through Shopify Collective.

Tuesday: The product appears in the curator's Shopify catalog automatically — photos, description, pricing, and variants (whole bean and ground), all populated from the roaster's data. The curator's team reviews the listing, then configures the drop: 200-bag limit, Friday morning at 9am ET.

Friday, 9:00am: The text goes out to subscribers. A photo of the bag, tasting notes, the story behind the farm, and the price. "Reply 1 to claim a bag."

Friday, 9:01am: Replies start coming in. Each reply triggers an instant order in the curator's Shopify store. Shopify Collective routes each order to the roaster's Shopify account in real time. The roaster's fulfillment team sees orders appearing as they're placed.

Friday, 10:42am: The drop sells out. All 200 bags purchased — not reserved, not pre-ordered, actually paid for. Every transaction processed the moment the subscriber replied. At $31 per bag, that's over $6,000 in revenue generated in under two hours, entirely through text messages. The drop automatically closes, a sold-out notification goes out, and the roaster already has every order in their system and begins printing shipping labels.

Friday afternoon: Bags start shipping directly from the roaster to subscribers across the country.

The curator didn't touch a single bag of coffee. The roaster didn't spend a dollar on customer acquisition. And 200 text subscribers are delighted with their purchase.

One practical note: the curator still owns the customer relationship. If a package is lost, damaged, or a subscriber has an issue, the curator handles that communication and coordinates with the vendor to resolve it. For many product categories — coffee, wine, specialty food — returns aren't a factor, so this mostly means handling the occasional shipping issue. It's not a set-and-forget arrangement, but with a close vendor relationship (which the drop model naturally creates), these situations are straightforward to resolve.

Why This Scales

The real power of this model isn't in any single drop — it's in what happens when you add the next vendor.

Traditional ecommerce partnerships create linear operational complexity. Every new vendor means new product pages to build, new fulfillment workflows to manage, new communication channels to maintain. At some point, the operational cost of adding another vendor exceeds the revenue they generate.

With Shopify Collective and text-to-buy, every new vendor follows the same pattern:

- Vendor authorizes products in Collective

- Products sync to the curator's Shopify catalog

- Curator configures a drop

- Subscribers reply to purchase

- Orders route to vendor for fulfillment

Adding vendor number twenty follows the same playbook as vendor number two. The infrastructure handles the complexity — the curator focuses on finding great products and great partners.

The effort is also controllable. The most common cadence we see is every other week — 26 drops a year. That's manageable for a solopreneur running this as a side project, and it's equally viable for a larger operation running multiple product categories. You control the pace. You're not staffing a year-round marketplace with thousands of SKUs and ongoing inventory questions. You're running a focused drop on your schedule.

This is fundamentally different from an always-on marketplace. A marketplace requires constant catalog management, vendor coordination, shipping logistics across multiple suppliers, and an endless stream of product updates. A drops program is episodic by design — each drop is its own self-contained event with a clear beginning and end. That structure is what makes it possible to work with dozens of vendors over time without drowning in operational overhead.

And here's the part that compounds: every drop is a discovery moment for your subscribers. They're not browsing a static catalog. They're getting introduced to a product they didn't know existed, from a producer they've never heard of, with a story behind it — delivered directly to their phone. That sense of discovery and whimsy is what keeps subscribers engaged and coming back. It's what makes this model sticky in a way that a marketplace storefront never could be.

Getting Started

If you're running a curator brand — or thinking about building one — the combination of Shopify Collective and text-to-buy is worth exploring. The model works for any product category where variety, exclusivity, and a trusted curator relationship create value.

Start by setting up Shopify Collective with your first vendor. Build a text subscriber list with AudienceTap's list growth tools. Run your first drop. Measure the results.

The brands that figure this out early build a moat: a direct, owned audience combined with a vendor network that grows without growing complexity. That's a hard combination for competitors to replicate.

Want to see this model in action? Read how one brand uses Shopify Collective and text-to-buy to power weekly coffee drops in our Fellow Drops case study.